Global Markets React to Disappointing Chinese Economic Data

Recent economic data from China has triggered a mixed reaction in global markets, highlighting concerns about the country’s slowing growth. Investors and analysts are closely watching these developments as they assess the broader implications for the global economy.

Disappointing Economic Indicators

The latest economic reports from China revealed weaker-than-expected growth in several key areas, including industrial production, retail sales, and fixed-asset investments. These indicators suggest that China, the world’s second-largest economy, is facing significant challenges in sustaining its rapid economic expansion. The slowdown has been attributed to multiple factors, including reduced domestic demand, ongoing trade tensions, and the lingering effects of the COVID-19 pandemic.

Global Market Reactions

The disappointing data from China sent ripples through global markets, leading to a mixed response across different regions. Asian markets were among the first to react, with stock indices in major economies such as Japan, South Korea, and Hong Kong experiencing declines. European markets followed suit, with investors expressing concerns about the potential spillover effects of China’s slowing economy on the region’s export-driven industries.

In contrast, some markets in the United States showed resilience, with certain sectors, such as technology and healthcare, seeing gains. However, overall market sentiment remained cautious as investors weighed the potential impact of China’s economic slowdown on global supply chains and demand for commodities.

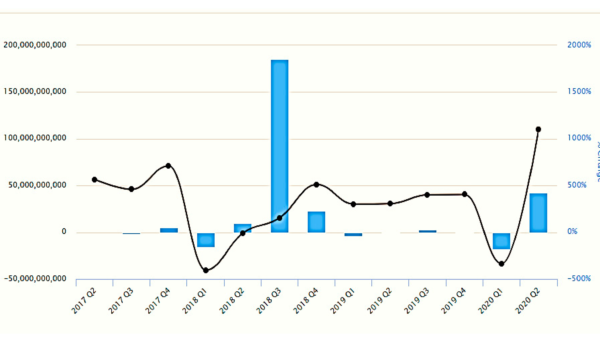

Impact on Commodity Prices

China’s economic performance has a significant influence on global commodity markets, given its status as a major consumer of raw materials. The recent data led to a decline in prices for key commodities such as oil, copper, and iron ore, reflecting concerns about reduced demand from China. This has added to the volatility in commodity markets, with producers and exporters facing uncertainty about future price trends.

Broader Economic Implications

The slowing growth in China has broader implications for the global economy. As a major driver of global trade and investment, any significant slowdown in China can have a ripple effect on other economies, particularly those heavily reliant on exports to the Chinese market. Countries in Asia, Africa, and Latin America, which have strong trade ties with China, are particularly vulnerable to these developments.

Moreover, China’s economic challenges could also impact global supply chains, given the country’s central role in manufacturing and distribution. Any disruptions in China’s industrial output could lead to delays and shortages in various industries, further complicating the global economic recovery.

Policy Responses and Future Outlook

In response to the disappointing economic data, the Chinese government is expected to introduce new policy measures to stimulate growth. These may include increased infrastructure spending, monetary easing, and targeted support for struggling sectors. However, the effectiveness of these measures remains uncertain, given the structural challenges facing China’s economy, including high levels of debt and a shrinking workforce.

Looking ahead, global markets will continue to monitor China’s economic performance closely. The ongoing challenges in the Chinese economy are likely to contribute to increased volatility in global markets, with investors remaining cautious about the potential risks to global growth.

Conclusion

The recent disappointing economic data from China has sparked a mixed reaction in global markets, reflecting widespread concerns about the country’s slowing growth. As the world’s second-largest economy grapples with significant challenges, the implications for global markets and the broader economy are profound. Investors, policymakers, and businesses around the world will be closely watching China’s next steps to navigate these uncertain times.